07 August 2019

As with most complex machines, cars will invariably begin to succumb to wear and tear. Unchecked, this gradual abrasion will end up exposing your vehicle to the increased risk of performance failure on the road. South African legislation requires that a vehicle undergo a standard inspection test and be issued with a roadworthiness certificate for the sale of any motor vehicle to take place.

These inspection tests are administered by trained, registered technicians whose job it is to ensure, in the interest of everybody’s safety, that the car is safe and in an appropriate condition to take to the road.

When selling and buying a car, a recognised, formal inspection test is necessary, but there are a few things you can check for yourself. This will give you a good impression on the overall state of the vehicle you’re buying.

The Tyres

Tyres are the first thing that inspectors look at. A quick once-over will give you a decent idea about the condition of these critical components. Tyres are the only point of contact between you and the road and should be checked regularly. Look for damage to the walls of the tyres, check that there is enough tread (grooves and edges in the rubber) remaining, and check the tyre pressure. Don’t forget the spare wheel, which is just as important to be in good condition and properly inflated.

Your Windscreen

Ensure that your windscreen is well-fitted and secure. The glass protects you from the wind, rain, and road debris. Debris especially can damage and obscure your windscreen. Check for small chips and have them repaired as soon as possible before they become cracks.

Lights and Basic Electrics

The electrical system of your car is complex and some elements need to be diagnosed digitally. You can perform a basic check by switching the car’s lights on, then checking each bulb – the headlights, brake lights, indicators, and fog lights. Ensure they illuminate fully without flickering or dimming when engaged.

The Exterior

Most buyers will not accept a car with a scratched or damaged exterior. Most scratches can be buffed out quite easily. Ask if any previous repair work has been done to the vehicle and inspect to make sure that the work is of a high standard.

The Interior

A clean, well-maintained interior should be free of any stains, grime, and suspicious smells!

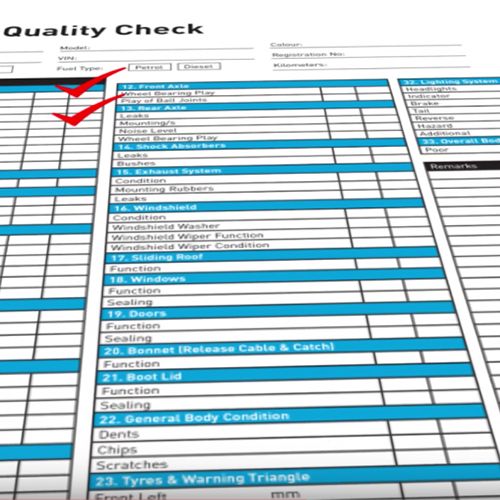

When your car goes for its roadworthiness inspection during the registration process, you can rest easy knowing that the Auto Pedigree 116-point check has covered all the bases.

What is included in a Vehicle Inspection?

There are a specified set of tests that your car must pass when registering the vehicle in your name. Inspectors will investigate a set of checks and tests before passing your car and declaring it safe and issuing the roadworthiness certificate.

These important components are checked to be in working condition during a vehicle inspection:

Brakes: Inspections will be conducted on the brakes’ individual components including the brake pads, disks, and lines.

Your Lights: All bulbs on the lamps, indicators and brake lights. Indicators must work independently and correctly.

Suspension: Apart from a detailed visual inspection of the shocks, the suspension must respond well to movement and the overall stability of the car.

Wheels: The tyres’ pressure, tread, and integrity, as well as the rims must be in good shape and the spare wheel must also conform to the minimum test requirements.

Chairs and Seatbelts: The seatbelts must have enough play to clip into the working seatbelt locking system. Seats must be secure and stable.

Fuel System: The fuel system must deliver enough petrol to the engine, with no leakage, and at an efficient rate. Air intake and filters will also be examined.

Engine: The engine and transmission must not stall, misfire, or overheat.

The Auto Pedigree 116-point check is developed to inspect as many components as possible in order to ensure every vehicle sold is as good as new.

How is the Auto Pedigree 116 test performed?

Auto Pedigree will ensure that the 116-point check is performed only by the most experienced, well-trained mechanics and engineers. This test demands that non-negotiable pass marks are achieved for the car to be listed to potential buyers. This way, when you buy a car from Auto Pedigree, you will know that it conforms only to the highest standards of quality.

Transmission, Engine, Fuel Lines

Part of the Auto Pedigree 116-point check involves testing three very important aspects – your transmission, the engine, and fuel lines. Together, these parts function as the power distribution system of your car. As these are often prone to wear and tear, they are investigated rigorously.

Transmission

This refers to your gearbox. The gearbox adapts the power output of your engine to drive your wheels. In a car with manual transmission, these gears are shifted and engaged manually using your gearstick. Automatic transmissions do this for you as you drive. Eventually the gearbox will succumb to degradation through use and parts will need to be replaced.

Engine

Our cars mostly use an internal combustion engine. This involves the mixing of fuel, air, and water, which is ignited. This all happens under high pressure and heat conditions. Each ignition creates energy that drives the pistons and sends energy to the wheels moving the car. Sounds simple? Not necessarily. Engines have many safety mechanisms, control valves and conduits and can be extremely complex. The heat and pressure can damage these components and expose the engine to failure over time. Each aspect is carefully checked, cleaned and corrected.

Fuel Lines

The veins of your car, fuel lines carry petrol from the tank to the engine. Sometimes, these rubber veins can split, puncture, or break. This can leave highly flammable fuel leaking beneath and unpleasant fumes into your car. Often these leaks are tiny and do not pose a fiery risk, but it may lead to expensive fuel loss and allow air into the fuel system, choking up the engine. Easy to replace, fuel lines are inspected in detail to ensure you’re as safe as can be.

Some of the other components that form part of the check include:

Air conditioning

Regulates the interior temperature and environment of the car. This system uses a lot of power to keep you comfortable. Clean-air filters are replaced, air-conditioning fluid topped off and all leaks repaired.

Steering

This critical function keeps you straight and safe on the road. From the wheels and the alignment to the steering column - all is calibrated to standard specifications.

Lighting systems

More than simply lighting the way, your lights perform the critical function of making you more visible, and telling other drivers what your intentions are (Like when stopping, turning, etc.) Faulty bulbs are replaced, fittings are cleaned, and all wire connections secured and insulated.

Exterior

All scratches, dents and marks are removed and repaired leaving the car looking in pristine condition.

Exhaust system

The “lungs” of your car, this important system runs the length of the vehicle from the engine to the rear. Exhaust systems, though sometimes prone to problems, are easy to repair. A healthy exhaust manifold will keep your ride purring along with minimal emissions – healthier for you and for the environment.

Undercarriage

Rocks, water, tar, and oil are just some of the elements that assault the undercarriage every time we drive, not to mention the grime that collects in the chassis below. It is cleaned, repaired and welded if necessary, ensuring the underneath of your car is solid and safe.

Brake system

This system is tested at length from having enough fluid in the lines, to replacing worn pads and discs. The brakes will also be properly calibrated to avoid over-sensitivity and to perform optimally.

Tyres

The tread depth and grip are determined to ensure they’re all up to specification. Any missing or damaged bolts and wheel nuts will be fitted in place, air valve caps replaced, and the wheels checked to ensure that they are correctly fitted and aligned.

Clutch

The clutch allows the gears to engage smoothly at different ratios. The clutch, cable, and gearbox are tested rigorously, so that the gears slip into place properly and the clutch allowed to operate.

Shock Absorbers

Attached to the wheel and vehicle axle, shock absorbers are tested to make travel more comfortable and to ensure the car is stable on the road.

Engine

As the heart and power source of your car, the engine is also the most complex part of the vehicle. Engineers will spend a good amount of time examining and conditioning this component to ensure it is running efficiently.

Windshield

The windscreen is one of the first things on the checklist. Often, chipped windscreens can be repaired, but if the damage is too great, will be replaced altogether.

Vehicle Interior

A full valet service is done with a thorough cleaning and disinfecting for a spotless, near-new interior.

Safety Belts

These lifesavers are thoroughly tested to ensure they comply only with the most stringent safety standards.

The Auto Pedigree 116-point check ensures that your engine, transmission, and fuel lines are in perfect working order. Nothing is left to chance and the car is then put through a detailed calibration to make sure these components work together in sync, saving you money and keeping you safe.